Let’s get started!

or

You seem to have an account with this email already.

Sign in

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Already have an account?

Sign in

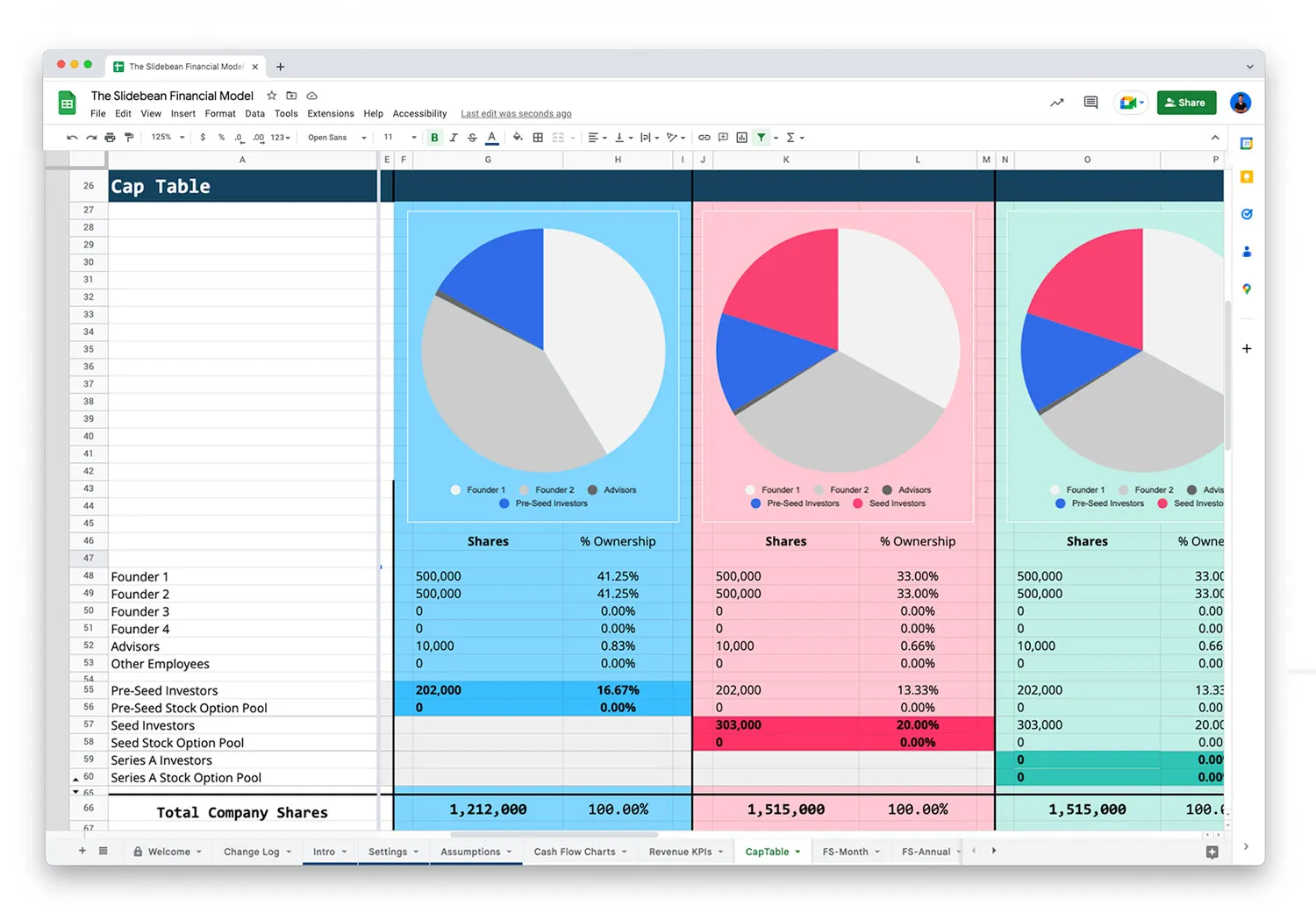

Google Sheets + Microsoft Excel Template

Custom SaaS Dashboards to track orders and profitability

Color-coded sheets that cover the basic expense and revenue categories for any financial model.

Estimate equity and convertible note rounds of funding, from Pre-Seed to Series C.

A complete knowledge base, and phone support available from our financial analysts.