Advice and answers from the Slidebean Team

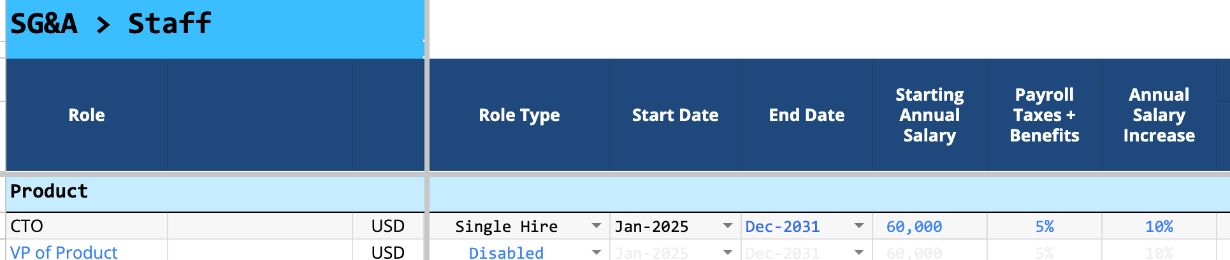

The Staff Sheet (SG&A > Staff)

The Staff Sheet serves as the central hub for managing all personnel-related expenses within your financial projections. It allows you to define individual roles, their salaries, start and end dates, and account for additional costs like payroll taxes and benefits. By centralizing this data, the model can accurately project your Selling, General & Administrative (SG&A) expenses related to your workforce.

Staff Roles and Salaries

The Staff sheet is designed so you think of 'roles' instead of unique employees.

Role Name:

A descriptive name for the position (e.g., CEO, Senior Developer, Marketing Specialist).

Role Type:

Options: Disabled, Single Hire, Scaling Team

- Disabled: When you select "Disabled," this role is effectively turned off in your financial projections. No salary or associated costs for this role will be included in your model.

- Single Hire: Choosing "Single Hire" indicates that you will have only one person in this specific role at any given time. When you set a start date, the costs for one employee in this role will begin to be accounted for. Examples of "Single Hire" roles might include CEO, CTO, or a specialized individual contributor.

- Scaling Team: selecting "Scaling Team" allows you to project the growth of a team within a specific role over time. When you choose this option, you'll see additional columns that allow you to specify how the number of employees in this role will increase in future months or years. This is ideal for departments that you expect to grow, such as Sales, Marketing, or Engineering teams.

Start and End Dates:

These fields allow you to specify the period during which the costs for a particular role will be included in your financial model.

- Start Month: This input field determines the first month in your projection period that the costs (salary, taxes, benefits) for this role will be accounted for. For example, if you plan to hire a Marketing Manager starting in June 2025, you would select "June 2025" as the Start Month for that role. The model will then begin including these expenses from June onwards.

Default Value: Model Start Date

- End Month (Optional): This input field allows you to specify the last month in your projection period that the costs for this role will be included. This is particularly useful for temporary positions, contract roles, or if you anticipate a role being eliminated. If you leave this field blank, the model will assume the role continues for the entire projection period.

Default Value: Model End Date

Salary Inputs

Starting Annual Salary:

This BLUE input field is where you enter the initial annual gross salary for the specified role. This figure will be used as the baseline for calculating the monthly salary and the associated payroll taxes and benefits.

Default Value: $0

Payroll Taxes + Benefits:

This section allows you to input the additional costs associated with employing someone, expressed as a percentage of their annual salary. This typically includes employer-paid payroll taxes, health insurance contributions, retirement matching, and other benefits.

Default Value: 5%

Annual Salary Increase:

This input field allows you to specify the anticipated annual percentage increase in the salary for this role. This helps to account for inflation, cost of living adjustments, or performance-based raises over the projection period.

Default Value: 10%

Starting Monthly Salary:

This output field automatically calculates the initial monthly gross salary by dividing the "Starting Annual Salary" by 12. This value is used as a basis for calculating the monthly cost to the company.

Monthly Cost to Company:

This output field represents the total monthly cost associated with this role, including the monthly salary, and the allocated monthly cost of payroll taxes and benefits. This is a key figure that contributes to your overall SG&A expenses.Default Value: Calculated based on salary, payroll taxes, and benefits.

Team Scaling (For "Scaling Team" Role Type)

Hires per period:

This input field (visible under "Scaling Team") determines how many new hires will be added to this role in each specified period.

Default Value: 1

How often are new hires added? (Freq):

This dropdown field (visible under "Scaling Team") specifies the frequency at which new hires will be added

Dropdown: Monthly, Quarterly, Every 6 Months, Annually

Maximum Team Size

This input field (visible under "Scaling Team") allows you to set a cap on the total number of employees for this specific role. Once this maximum is reached, no further hires will be projected for this role.

Default Value: 5

Equity & Stock Options:

This column links to your company's Cap Table to allow you to estimate the equity ownership of founders and employees, either by granting Common Shares or Stock Options.

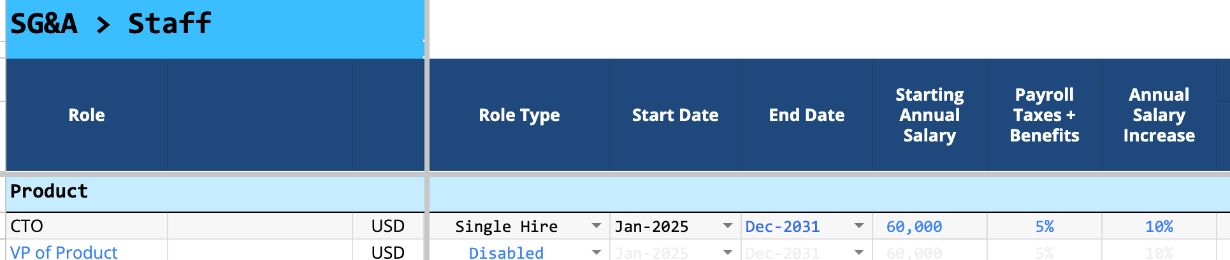

The Staff Sheet serves as the central hub for managing all personnel-related expenses within your financial projections. It allows you to define individual roles, their salaries, start and end dates, and account for additional costs like payroll taxes and benefits. By centralizing this data, the model can accurately project your Selling, General & Administrative (SG&A) expenses related to your workforce.

Staff Roles and Salaries

The Staff sheet is designed so you think of 'roles' instead of unique employees.

Role Name:

A descriptive name for the position (e.g., CEO, Senior Developer, Marketing Specialist).

Role Type:

Options: Disabled, Single Hire, Scaling Team

- Disabled: When you select "Disabled," this role is effectively turned off in your financial projections. No salary or associated costs for this role will be included in your model.

- Single Hire: Choosing "Single Hire" indicates that you will have only one person in this specific role at any given time. When you set a start date, the costs for one employee in this role will begin to be accounted for. Examples of "Single Hire" roles might include CEO, CTO, or a specialized individual contributor.

- Scaling Team: selecting "Scaling Team" allows you to project the growth of a team within a specific role over time. When you choose this option, you'll see additional columns that allow you to specify how the number of employees in this role will increase in future months or years. This is ideal for departments that you expect to grow, such as Sales, Marketing, or Engineering teams.

Start and End Dates:

These fields allow you to specify the period during which the costs for a particular role will be included in your financial model.

- Start Month: This input field determines the first month in your projection period that the costs (salary, taxes, benefits) for this role will be accounted for. For example, if you plan to hire a Marketing Manager starting in June 2025, you would select "June 2025" as the Start Month for that role. The model will then begin including these expenses from June onwards.

Default Value: Model Start Date

- End Month (Optional): This input field allows you to specify the last month in your projection period that the costs for this role will be included. This is particularly useful for temporary positions, contract roles, or if you anticipate a role being eliminated. If you leave this field blank, the model will assume the role continues for the entire projection period.

Default Value: Model End Date

Salary Inputs

Starting Annual Salary:

This BLUE input field is where you enter the initial annual gross salary for the specified role. This figure will be used as the baseline for calculating the monthly salary and the associated payroll taxes and benefits.

Default Value: $0

Payroll Taxes + Benefits:

This section allows you to input the additional costs associated with employing someone, expressed as a percentage of their annual salary. This typically includes employer-paid payroll taxes, health insurance contributions, retirement matching, and other benefits.

Default Value: 5%

Annual Salary Increase:

This input field allows you to specify the anticipated annual percentage increase in the salary for this role. This helps to account for inflation, cost of living adjustments, or performance-based raises over the projection period.

Default Value: 10%

Starting Monthly Salary:

This output field automatically calculates the initial monthly gross salary by dividing the "Starting Annual Salary" by 12. This value is used as a basis for calculating the monthly cost to the company.

Monthly Cost to Company:

This output field represents the total monthly cost associated with this role, including the monthly salary, and the allocated monthly cost of payroll taxes and benefits. This is a key figure that contributes to your overall SG&A expenses.Default Value: Calculated based on salary, payroll taxes, and benefits.

Team Scaling (For "Scaling Team" Role Type)

Hires per period:

This input field (visible under "Scaling Team") determines how many new hires will be added to this role in each specified period.

Default Value: 1

How often are new hires added? (Freq):

This dropdown field (visible under "Scaling Team") specifies the frequency at which new hires will be added

Dropdown: Monthly, Quarterly, Every 6 Months, Annually

Maximum Team Size

This input field (visible under "Scaling Team") allows you to set a cap on the total number of employees for this specific role. Once this maximum is reached, no further hires will be projected for this role.

Default Value: 5

Equity & Stock Options:

This column links to your company's Cap Table to allow you to estimate the equity ownership of founders and employees, either by granting Common Shares or Stock Options.

Oops, We Couldn’t Find That… But We’re Here to Help!

Looks like we don’t have an exact match for your search.

But perhaps our other articles may cover what you’re looking for!