35+ Best Pitch Deck Examples from Successful Startups (2024 Update with Editable Templates Included)

There’s no single recipe for creating a successful investor pitch deck. Many authors, venture capitalists, startup founders, and evangelists have created different versions of the required content structure for successfully pitching investors. The reality is that different industries, company stages, and round sizes require slightly different approaches to business storytelling.

We’ve compiled a list of the 35 best pitch deck examples from successful startups, accelerator programs, and industry experts (updated to 2024), in the hope that it helps you craft your next investor presentation.

Quick access to our best templates:

- Airbnb Pitch Deck

- The Startup Pitch Deck Template

- Investor Deck Template by 500 Startups

- Investment Proposal

- Uber Pitch Deck

- Business Plan Template

- Sequoia Capital Pitch Deck

- Doordash Pitch Deck

- Facebook Pitch Deck

- Ycombinator Pitch Deck Template

- Guy Kawasaki Pitch Deck Template

- Youtube Pitch Deck

- Slidebean Pitch Deck

- Peloton Pitch Deck

- Go To Market Strategy Template

- Elevator Pitch Deck Template

- Tinder Pitch Deck Template

- WeWork Pitch Deck Template

- Snapchat Pitch Deck Template

- Linkedin Pitch Deck Template

- Lunchbox Pitch Deck Template

- Buffer Pitch Deck

- Cannabis Pitch Deck Template

- Aircall Pitch Deck

- Intercom Pitch Deck Template

- Cryptocurrency Pitch Deck Template

- Copy AI Pitch Deck Template

- Splitwise Pitch Deck Template

- 3 Minute Pitch Deck for Demo Day Template

- Sparkcharge Pitch Deck

- Dwolla Pitch Deck Template

- Evervault Pitch Deck Template

- Vettery Pitch Deck Template

- Dutchie Pitch Deck Template

- Sololearn Pitch Deck Template

100+ pitch deck templates here

These are our best 35+ startup pitch decks:

1. Airbnb Pitch Deck Template

The Airbnb Pitch Deck is one of the most searched references on the internet, probably because it’s a company so familiar to us all. This is a classic 10-slide Investor Deck template that many startups find useful to fit their startup into. We’ve reimagined the original deck and created our fill-in-the-blank template.

- Industry: Travel, Hospitality, Technology

- Business Model: Online marketplace for lodging and travel experiences

- Amount Raised: $500K Angel Round

- Location: San Francisco, California, USA

- Website: airbnb.com

USE AIRBNB TEMPLATE

2. The Startup Pitch Deck Template

What you should include in your pitch deck is a question that entrepreneurs have been asking themselves for years. The template we created, distilled from benchmarking dozens of venture-backed startups, takes this into account so all users will have more clarity on where their strengths are!

USE STARTUP PITCH DECK TEMPLATE

3. Investor Deck Template by 500 Startups

500 Startups is a leading global venture capital seed fund and startup accelerator headquartered in Silicon Valley with over $350M AUM.

This investor deck template is ideal for initial VCs and Angel Investors. If they ask to see your pitch deck, this is what you want to send.

The outline of the investor deck mainly focuses on your startup's growth metrics and traction.

- Industry: Capital market company

- Location: San Francisco, California, USA

- Website: 500.co

USE INVESTOR DECK TEMPLATE

4. Investment Proposal Template by Nextview Ventures

An investment proposal is the driving tool during a meeting with potential investors. This investor deck contains all the information they require. It was created based on the NextView Ventures template.

- Industry: Venture Capital company

- Location: New York, New York, USA

- Website: nextview.vc

USE INVESTMENT TEMPLATE

5. Uber Pitch Deck Template

For the ninth anniversary of the founding of Uber, it's co-founder Garret Camp shared the first slides they created in late 2008. At the beginning, Uber was originally called UberCab, and it has evolved from a simple idea into a major platform that has improved the car service industry.

- Industry: Transportation, Technology

- Business Model: Ride-sharing and food delivery platform

- Amount Raised: $1.3 million

- Location: San Francisco, California, USA

- Website: uber.com

Here you have Uber's 25 slide deck! There's a lot to be learned from their first ever pitch:

USE UBER TEMPLATE

6. Business Plan Template

The Business Plan is a crucial step in starting your own business because it represents the goals you want to achieve and outlines how they will be accomplished.

USE BUSINESS PLAN TEMPLATE

7. Sequoia Capital Pitch Deck

Since Sequoia Capital has quite a reputation for investments, taking a page out of their book makes sense. The slides included in the Sequoia Capital Pitch Deck Template each have a specific purpose that leads them down the path of discovery into your pitch

- Industry: Venture Capital company

- Location: San Francisco, California, USA

- Website: sequoiacap.com

Related read: What is a pitch deck presentation

USE SEQUOIA TEMPLATE

8. Doordash Pitch Deck Template

DoorDash is one of the most well-known food delivery companies in the United States right now. The Doordash investor deck is an excellent example of a pitch using traction to back up your business.

- Industry: Food Delivery, Technology

- Business Model: On-demand food delivery platform

- Amount Raised: $2.4 million

- Location: San Francisco, California, USA

- Website: doordash.com

USE DOORDASH TEMPLATE

9. Facebook Pitch Deck Template

Facebook’s original pitch deck was a media kit containing the company’s value proposition, key metrics, and Online Marketing Services.

At that time, the company wasn’t making any money from The Facebook, so they bet on solid numbers such as user engagement, customer base, and growth metrics.

- Industry: Social Media, Technology

- Business Model: Social networking and advertising platform

- Location: Menlo Park, California, USA

- Website: facebook.com

USE FACEBOOK TEMPLATE

10. Ycombinator Pitch Deck Template

YCombinator came out with a pitch deck template that's not aesthetically pleasing. We get it. They wanted to give you the “blank canvas” so your company branding could shine, but maybe they went too far. In any case, we've taken matters into our own hands and made some style changes for better aesthetics and more functionality. We hope this helps.

- Industry: Startup accelerator company

- Location: Mountain View, California, USA

- Website: ycombinator.com

USE YCOMBINATOR TEMPLATE

11. Guy Kawasaki Pitch Deck Template

Guy Kawasaki is a well-known Silicon Valley startup guru. He is the author of several books and was one of the original Apple employees. His 10 pitch deck slides have inspired many, and his 20-minute presentation format will help you get your point across efficiently.

USE GUY KAWASAKI TEMPLATE

12. Youtube Pitch Deck Template

Youtube’s pitch deck was used in 2005 when it had less than 10,000 users. It was actually quite straightforward. They used an elementary version of a 10 slide pitch deck to go up in front of Sequoia Capital for fundraising. Still, the company was able to raise $3.5M in that Series A round November of that year. This cost around 30% of the stakes in the company.

- Industry: Video Streaming, Music, Internet

- Business Model: Ad revenue and user subscriptions.

- Amount Raised: $3.5 million Series A

- Location: San Bruno, California, USA

- Website: youtube.com

USE YOUTUBE TEMPLATE

13. Slidebean Pitch Deck

Our slide deck at the 500 Startups demo day was the culmination of 2 startup accelerator processes, hours of rehearsal, and dozens of adjustments thanks to feedback from our mentors. Pitching at a Demo Day event differs from pitching to an investor in a one-on-one meeting.

- Industry: Software, Design, Productivity

- Business Model: Presentation software with design support

- Location: New York City, New York, USA

- Website: slidebean.com

USE SLIDEBEAN TEMPLATE

14. Peloton Pitch Deck Template

Peloton broke the fitness industry with its stationary bike system, which connects users and trainers via the internet. Do you have a business idea for this industry in mind? We recreated the pitch deck Peloton used to raise their Series F.

- Industry: Fitness, Technology

- Business Model: Subscription-based connected fitness platform

- Location: New York City, New York, USA

- Amount raised: $500 million Series F

- Website: onepeloton.com

USE PELOTON TEMPLATE

15. Go To Market Strategy Template

The go-to-market strategy is a presentation that details how an organization will place its products in the market to reach maximum penetration and profitability. What is your go-to-market strategy? This template will help you summarize it engagingly!

USE GO TO MARKET TEMPLATE

16. Elevator Pitch Deck Template

This is an elevator pitch deck template designed for initial approaches to investors. Share this template when they ask for your elevator pitch deck. With this template, you can effectively communicate your value proposition, market opportunity, key achievements, and financial projections, aiming to get the investors' curiosity and interest for further discussions.

Use this template

17. Tinder Pitch Deck Template

10 billion matches later, Tinder has changed how people meet around the world. It’s so much more than a dating app. Tinder is a powerful tool for meeting people.

Here’s the deck Tinder used in the IAC Hatch Labs Incubator in 2012.

- Industry: Social Media, Dating App

- Business Model: Subscription service, ad revenue

- Amount Raised: Approximately $50 million in total funding

- Location: West Hollywood, California, USA

Use this template

18. WeWork Pitch Deck Template

WeWork fuels entrepreneurial spirit and corporate success with powerful real estate solutions. Founded in 2010, it has since blossomed into a buzzing global community transforming the way companies do business by providing physical spaces that nurture productivity, well-being, efficiency and growth - all backed up by an impressive $1 billion funding valuation of $10 billion!

- Industry: Real Estate, Coworking, Proptech

- Business Model: Office space rental

- Amount Raised: $42.8 million Series E

- Location: New York, New York, USA

- Website: wework.com

GET THIS TEMPLATE

19. Snapchat Pitch Deck Template

The Snapchat Pitch Deck Template helps you create a persuasive presentation inspired by Snapchat's successful pitch to investors. It offers visually engaging slides and a structured format for showcasing your business idea, growth plans, and revenue strategy.

- Industry: Social Media, Messaging, Technology

- Business Model: Photo-based social media

- Amount Raised: Approximately $4.9 billion in total funding

- Location: Venice, California, USA

Use this template

20. Linkedin Pitch Deck

LinkedIn has skyrocketed to success, becoming the world's largest professional social networking site with a vast population of users growing daily. Reid Hoffman later publicly released his Series B pitch deck, which included advice on how it should be constructed so that other aspiring entrepreneurs would also have insight.

- Industry: Social Media, Networking, Technology

- Business Model: Professional networking site

- Amount Raised: $10 million Series B

- Location: Sunnyvale, California, USA

- Website: linkedin.com

Get this template

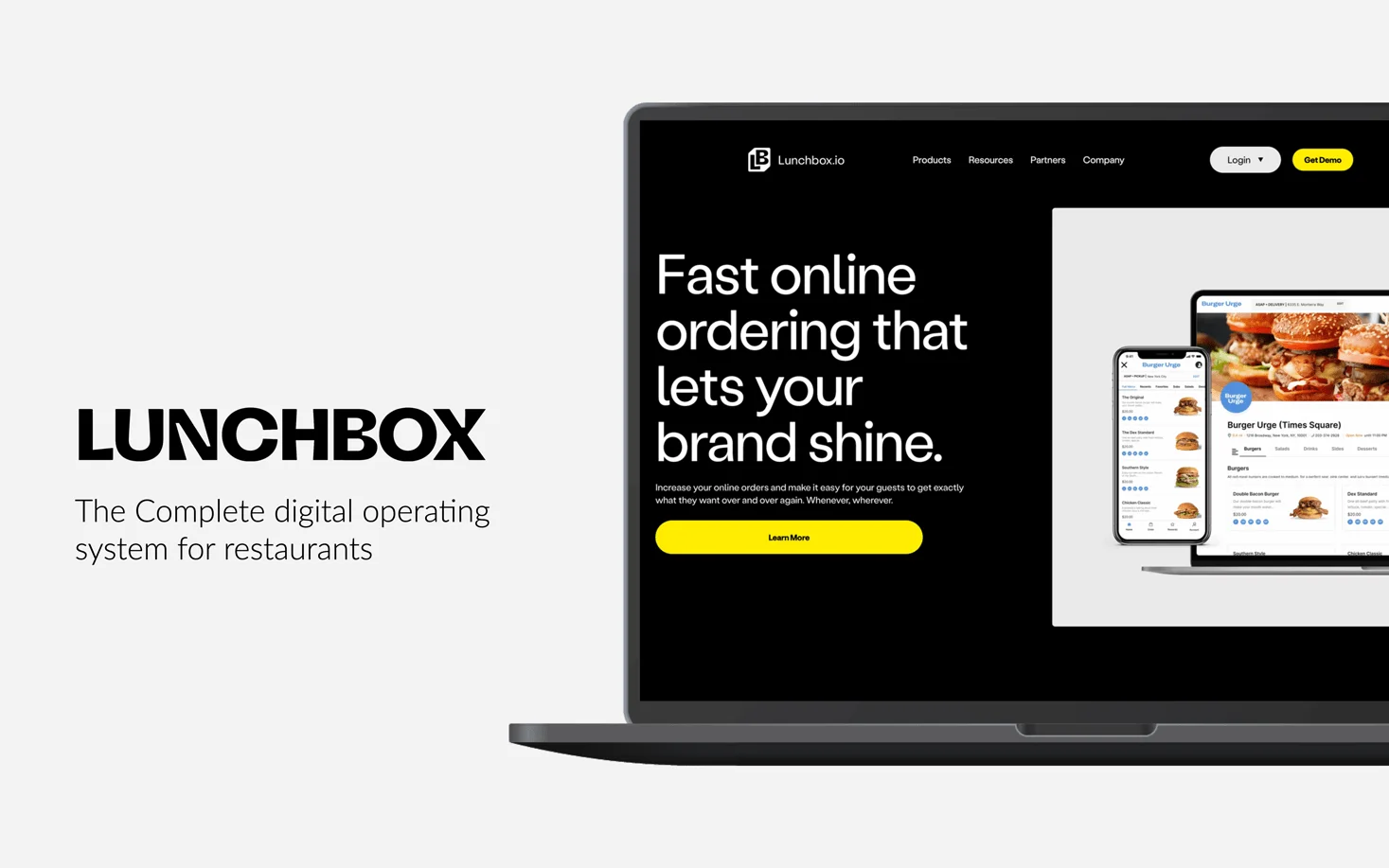

21. Lunchbox Pitch Deck Template

With a mission to empower restaurants to compete in an increasingly tech-driven market, Try our Pitch Deck Template inspired by the one they used to raise $2 million in its seed round.

- Industry: Restaurants, Management Software

- Business Model: B2B Restaurant platform

- Amount Raised: $2 million Seed Round

- Location: New York, New York, USA

- Website: lunchbox.io

Use this template

22. Buffer Pitch Deck Template

This is the presentation deck Buffer used to raise $500,000 for their startup, as redesigned by Slidebean. The highlight of this deck is the traction slide, which the founders describe as the critical one for their success.

- Industry: Social Media, Technology

- Business Model: Social media management platform

- Amount Raised: $500K

- Location: San Francisco, California, USA

- Website: buffer.com

USE BUFFER TEMPLATE

23. Cannabis Investor Pitch Deck Template

Leverage our Cannabis Investor Pitch, influenced by the CannaBusinessPlans deck, to effectively showcase the distinctive attributes and growth potential of your cannabis business. Utilize this tailored presentation as a powerful tool to attract essential funding from potential investors

Use this template

24. Aircall Pitch Deck

A well-designed pitch deck can help an entrepreneur communicate their story in a clear and concise way and can be a key tool in securing funding. However, designing a pitch deck can be a challenge, as it requires distilling complex information into bite-sized chunks and conveying it in an engaging way. That's why we decided to redesign Aircall's pitch deck as an example. We wanted to show how a pitch deck can be both informative and visually appealing.

- Industry: Telecommunications, Technology

- Business Model: Cloud-based phone system and call center software

- Amount Raised: $65 million

- Location: Paris, France, and New York City, USA

- Website: aircall.io

Here's the result from our design challenge:

Use Aircall Template

25. Intercom Pitch Deck Template

The Intercom Pitch Deck Template is your key to crafting a compelling pitch presentation, modeled after Intercom's own successful pitch.

It's your tool to create a persuasive presentation that mirrors Intercom's winning pitch style. This template empowers you to clearly communicate your business vision, product strategy, and growth prospects to potential investors.

- Industry: CRM, Marketing, Automation

- Business Model: B2B SaaS

- Amount Raised: $600K

- Location: San Francisco, California, USA

- Website: intercom.com

Use this template

26. Cryptocurrency Pitch Deck Template

A cryptocurrency pitch deck is a dynamic presentation outlining the unique attributes of a digital currency project. It showcases use cases, team expertise, and financial projections to attract funding and build investor confidence.

Use this template

27. Copy AI Pitch Deck Template

Copy.ai offers the convenience of composing emails, website content, and heartfelt love letters. Here's the pitch deck that convinced investors like Wing, Sequoia, and Tiger Global to contribute $11 million in funding.

- Industry: SAI, Copywriting, Automation

- Business Model: SaaS

- Amount Raised: $11 Series A

- Location: Memphis, Tennesee, USA

- Website: copy.ai

Use this template

28. Splitwise Pitch Deck Template

Splitwise makes it super easy to divvy up bills and expenses among friends or groups with their simple app. Check out our Pitch Deck Template, inspired by Splitwise's $20 million Series A round, to show investors what you're all about and kickstart your journey to success.

- Industry: FinTech, Billing, Personal Finance

- Business Model: Ad revenue, subscription service

- Amount Raised: $20 million Series A

- Location: Providence, Rhode Island, USA

- Website: splitwise.com

Use this template

29. 3 Minute Pitch Deck for Demo Day Template

Demo days pack together dozens of pitch decks from wildly different companies. Communicating your value prop effectively and concisely is key. This template provides the structure to accomplish pitching your startup in under 3 minutes.

Use 3 Minute Pitch Deck

30. Sparkcharge Pitch Deck

Sparcharge is a startup that raised $7 million in seed funding, and Slidebean was responsible for writing and designing their pitch deck. The deck was very successful in conveying the company's value proposition and vision, and it helped them to secure funding from top venture capitalists. The design of the deck was clean and professional, and it made use of strong visuals to help tell the company's story. The slides were also easy to navigate, which made it easy for investors to understand the information presented. Overall, the pitch deck was an important part of Sparcharge's success in raising funding, and it served as a great example of the power of a well-designed presentation.

- Industry: Automotive, Energy, Technology

- Business Model: Electric vehicle charging infrastructure

- Amount Raised: $7 million Series A

- Location: Boston, Massachusetts, USA

- Website: sparkcharge.io

Check these Slides

31. Dwolla Pitch Deck Template

Dwolla is advertised as "the best way to move money." 28-year-old Ben Milne has found a way to transfer money from the consumer or merchant to make a payment. This is Dwolla's Pitch Deck.

- Industry: Fintech

- Business Model: SaaS, transaction fees, partnerships

- Amount Raised: $16.5 million, Series C

- Location: Des Moines, Iowa, United States

- Website: dwolla.com

Use this template

32. Evervault Pitch Deck Template

According to their website, Evervault's mission "is to make data privacy simple and accessible for all" by allowing developers to integrate data privacy in their apps. How did they gain their attention (and money)? Here's the pitch deck that made that happen, as redesigned by Slidebean.

- Industry: Encryption Software

- Business Model: usage-based

- Amount Raised: $3.2 million, Seed Round

- Location: Dublin, Ireland

- Website: evervault.com

Use Evervault template

33. Vettery Pitch Deck Template

Here’s the Vettery pitch deck used to raise $9 million Series A on August 16, 2016, by co-founders Brett Adcock and Adam Goldstein.

- Industry: Hiring marketplace

- Business Model: SaaS, transaction fees

- Amount Raised: $9 million, Series A

- Location: New York, United States

- Website: hired.com

Use Vettery template

34. Dutchie Pitch Deck Template

Dutchie is one of the fastest-growing cannabis companies in the world. They provide e-commerce and point-of-sale solutions for dispensaries across North America.

- Industry: Cannabis

- Business Model:

- Amount Raised: $35 million Series B

- Location: Oregon, United States

- Website: business.dutchie.com

Use Dutchie template

35. Sololearn Pitch Deck Template

Sololearn, the Armenia-based instructional coding app, revolutionizes how people learn to code, with interactive lessons and peer-to-peer guidance.

- Industry: Ed-tech startup

- Business Model: Freemium, SaaS, Partnerships

- Amount Raised: $24 million Series B

- Location: San Francisco, California, United States

- Website: sololearn.com

Use Sololearn template

What is a pitch deck?

A pitch deck is usually a simple 10-20 slide presentation designed to help founders raise venture capital.

It should give a brief and compelling presentation of a new business idea that entrepreneurs give to potential investors, customers, or partners. It's a chance for them to showcase their vision, explain their unique value proposition, and demonstrate their growth potential.

To create an effective pitch deck, it's crucial to cover a few key points, such as the problem the startup is addressing, the market opportunity it has identified, the team's expertise, and the execution plan. Moreover, highlighting the competitive advantage and potential return on investment can attract investors' attention and interest.

A successful pitch can lead to funding, partnerships, and growth opportunities. However, crafting one requires in-depth knowledge of the market, audience, and business model, as well as excellent communication and storytelling skills.

What should be in an investor deck presentation?

When creating a pitch deck presentation, it's important to remember that you only have a limited amount of time to capture your audience's attention and persuade them to invest in your company. Your deck should be concise and easy to understand, while still providing enough information to show that your business is worth investing in.

Some key things to include in your pitch deck are an overview of your business, information about your target market and competitors, your product or service, how you plan to make money, and a summary of your team. You should also have a section highlighting the risks and challenges associated with your business, as well as what sets you apart from the competition.

Most authors agree on the following investor pitch deck outline requirements:

- Problem

- Solution

- Product

- Market Size

- Business Model

- Underlying Magic

- Competition

- Better/Different

- Marketing Plan

- Team Slide

- Traction / Milestones

If you're looking for more specific advice on creating a pitch the Slidebean team can guide you through the whole process.

Remember, investors have limited time, so be sure to prioritize key elements like the problem you're solving, your target market, the competitive landscape, your unique value proposition, and your financial projections.

More FAQs about pitch decks:

How to create a great pitch deck?

Your pitch deck is one of the most important tools in your arsenal. If you're pitching your startup idea or product, it's an opportunity to make a lasting impression on potential investors. And while there are many different types of decks out there, the best ones focus on three key points:

1. What problem do you solve?

2. How do you solve that problem?

3. Why should someone invest in you?

The presentation itself shouldn't take longer than 15 minutes, and it should be easy to follow along.

How to design pitch decks for investors?

A pitch deck is an important tool when pitching investors. It helps you present your business idea clearly and concisely, so they understand exactly why their investment will be profitable.

The first step is to create a list of all the things that need to be included in your pitch deck. For example, you may want to include:

- A clear description of your product/service

- An overview of your company's mission statement

- Your target market

- The benefits your product offers

- How much money you expect to raise

- Why your startup is unique

- What are your plans for growth

Once you have created this list, you can begin designing your pitch deck. You'll need to choose a template that best suits your needs. We offer over 100+ different pitch deck templates that can be used as inspiration.

How to write a successful pitch deck?

Mastering the art of creating an irresistible pitch deck can seem like a daunting task, but it shouldn’t. We're here to guide you through the process. First and foremost, you need a compelling narrative that showcases your business idea, market opportunity, and growth potential. Keep your pitch deck concise and visually appealing, with clear, simple language that gets straight to the point.

Remember, investors have limited time, so be sure to prioritize key elements like the problem you're solving, your target market, the competitive landscape, your unique value proposition, and your financial projections.

Now, if you're feeling a bit overwhelmed or simply want to supercharge your pitch deck, Slidebean's Agency Team is here to save the day. Our seasoned experts have a proven track record of helping companies raise more than $300 million in funds, and they're eager to help you reach the same heights. From crafting a compelling narrative to designing stunning visuals that captivate investors, our Agency Team will work with you every step of the way to create a pitch deck that not only looks great but also delivers results. With Slidebean by your side, you can focus on what you do best - building your business - while we take care of the rest.

Pitch Deck Presentation Service

Slidebean provides a premium service for startups, entrepreneurs, investors, and creatives who want to make better presentations. Our team of experts designs amazing slide decks every week. We want your audience to understand what you do and why you do it. If you want to start a new project, you can do it here: Slidebean Presentation Design Service

Besides the pitch deck examples we shared here, we have created, curated and redesigned several investor deck and set them as templates on our platform. Our presentation templates provide a fill-in-the-blank outline that can kick start your presentation workflow. Create a pitch deck that gets you funded. Browse templates from the most successful startups on the planet. Check them all here.

Get 100+ Templates

What is the goal of a company pitch deck?

The main goal of a company pitch decks is to:

- Attract investment from potential investors.

- Clearly explain what the company does and why it's valuable.

- Build trust in the team and business strategy.

- Show the market opportunity and growth potential.

- Highlight achievements and progress.

- Present financial projections.

- Request a specific amount of funding.

- Spark interest for further discussions.

How much does it cost to make a pitch deck?

There is no one-size-fits-all answer to this question, as the cost of making a pitch deck will vary depending on the level of detail and complexity involved. However, on average, you can expect to pay around $1,200-$6,000 for a high-quality investor deck. You can check Slidebean's prices here.

What is a Demo day?

A demo day refers to an event where entrepreneurs and startups showcase their products or services to potential investors, industry experts, and the general public. It is typically organized by incubators, accelerators, or venture capital firms to provide a platform for startups to present their business ideas, prototypes, or early-stage products.

During a demo day, each participating startup is given a specific amount of time, usually ranging from a few minutes to around 10 minutes, to deliver a presentation or pitch. The objective is to captivate the audience, generate interest in their venture, and attract potential investors or partners.

The text you provided highlights some key considerations when preparing for a demo day presentation versus a pitch deck presentation. For a demo day, the emphasis is on delivering a visually appealing presentation with minimal text. Since the audience may be seated at a distance, it is important to focus on visual elements that can be easily seen and understood. The presenter plays a crucial role in conveying the information and engaging the audience.

In contrast, a pitch presentation that is intended to be emailed should be self-explanatory, as it may be viewed on a laptop monitor where smaller fonts can be read comfortably. It is beneficial to track the recipient's activity on the presentation, such as whether they have read all the slides, as this information can inform the frequency of follow-up emails and help gauge their level of interest.

These considerations and tools for tracking viewer engagement are particularly valuable when seeking investment opportunities. Startups can utilize pitch deck platforms that offer features to monitor investor activity, which can play a critical role in securing funding.

Create beautiful and simple pitch decks with Slidebean

Unlock your full pitching potential with Slidebean! Say goodbye to design headaches and hello to a seamless experience focused on your pitch content. With customizable templates, stunning visuals, and automated formatting, Slidebean ensures your pitch deck stands out from the competition. Don't waste another minute wrestling with design software. Try Slidebean now and take your pitches to the next level!

START YOUR PITCH DECK

35+ Best Pitch Deck Examples from Successful Startups (2024 Update with Editable Templates Included)

There’s no single recipe for creating a successful investor pitch deck. Many authors, venture capitalists, startup founders, and evangelists have created different versions of the required content structure for successfully pitching investors. The reality is that different industries, company stages, and round sizes require slightly different approaches to business storytelling.

We’ve compiled a list of the 35 best pitch deck examples from successful startups, accelerator programs, and industry experts (updated to 2024), in the hope that it helps you craft your next investor presentation.

Quick access to our best templates:

- Airbnb Pitch Deck

- The Startup Pitch Deck Template

- Investor Deck Template by 500 Startups

- Investment Proposal

- Uber Pitch Deck

- Business Plan Template

- Sequoia Capital Pitch Deck

- Doordash Pitch Deck

- Facebook Pitch Deck

- Ycombinator Pitch Deck Template

- Guy Kawasaki Pitch Deck Template

- Youtube Pitch Deck

- Slidebean Pitch Deck

- Peloton Pitch Deck

- Go To Market Strategy Template

- Elevator Pitch Deck Template

- Tinder Pitch Deck Template

- WeWork Pitch Deck Template

- Snapchat Pitch Deck Template

- Linkedin Pitch Deck Template

- Lunchbox Pitch Deck Template

- Buffer Pitch Deck

- Cannabis Pitch Deck Template

- Aircall Pitch Deck

- Intercom Pitch Deck Template

- Cryptocurrency Pitch Deck Template

- Copy AI Pitch Deck Template

- Splitwise Pitch Deck Template

- 3 Minute Pitch Deck for Demo Day Template

- Sparkcharge Pitch Deck

- Dwolla Pitch Deck Template

- Evervault Pitch Deck Template

- Vettery Pitch Deck Template

- Dutchie Pitch Deck Template

- Sololearn Pitch Deck Template

100+ pitch deck templates here

These are our best 35+ startup pitch decks:

1. Airbnb Pitch Deck Template

The Airbnb Pitch Deck is one of the most searched references on the internet, probably because it’s a company so familiar to us all. This is a classic 10-slide Investor Deck template that many startups find useful to fit their startup into. We’ve reimagined the original deck and created our fill-in-the-blank template.

- Industry: Travel, Hospitality, Technology

- Business Model: Online marketplace for lodging and travel experiences

- Amount Raised: $500K Angel Round

- Location: San Francisco, California, USA

- Website: airbnb.com

USE AIRBNB TEMPLATE

2. The Startup Pitch Deck Template

What you should include in your pitch deck is a question that entrepreneurs have been asking themselves for years. The template we created, distilled from benchmarking dozens of venture-backed startups, takes this into account so all users will have more clarity on where their strengths are!

USE STARTUP PITCH DECK TEMPLATE

3. Investor Deck Template by 500 Startups

500 Startups is a leading global venture capital seed fund and startup accelerator headquartered in Silicon Valley with over $350M AUM.

This investor deck template is ideal for initial VCs and Angel Investors. If they ask to see your pitch deck, this is what you want to send.

The outline of the investor deck mainly focuses on your startup's growth metrics and traction.

- Industry: Capital market company

- Location: San Francisco, California, USA

- Website: 500.co

USE INVESTOR DECK TEMPLATE

4. Investment Proposal Template by Nextview Ventures

An investment proposal is the driving tool during a meeting with potential investors. This investor deck contains all the information they require. It was created based on the NextView Ventures template.

- Industry: Venture Capital company

- Location: New York, New York, USA

- Website: nextview.vc

USE INVESTMENT TEMPLATE

5. Uber Pitch Deck Template

For the ninth anniversary of the founding of Uber, it's co-founder Garret Camp shared the first slides they created in late 2008. At the beginning, Uber was originally called UberCab, and it has evolved from a simple idea into a major platform that has improved the car service industry.

- Industry: Transportation, Technology

- Business Model: Ride-sharing and food delivery platform

- Amount Raised: $1.3 million

- Location: San Francisco, California, USA

- Website: uber.com

Here you have Uber's 25 slide deck! There's a lot to be learned from their first ever pitch:

USE UBER TEMPLATE

6. Business Plan Template

The Business Plan is a crucial step in starting your own business because it represents the goals you want to achieve and outlines how they will be accomplished.

USE BUSINESS PLAN TEMPLATE

7. Sequoia Capital Pitch Deck

Since Sequoia Capital has quite a reputation for investments, taking a page out of their book makes sense. The slides included in the Sequoia Capital Pitch Deck Template each have a specific purpose that leads them down the path of discovery into your pitch

- Industry: Venture Capital company

- Location: San Francisco, California, USA

- Website: sequoiacap.com

Related read: What is a pitch deck presentation

USE SEQUOIA TEMPLATE

8. Doordash Pitch Deck Template

DoorDash is one of the most well-known food delivery companies in the United States right now. The Doordash investor deck is an excellent example of a pitch using traction to back up your business.

- Industry: Food Delivery, Technology

- Business Model: On-demand food delivery platform

- Amount Raised: $2.4 million

- Location: San Francisco, California, USA

- Website: doordash.com

USE DOORDASH TEMPLATE

9. Facebook Pitch Deck Template

Facebook’s original pitch deck was a media kit containing the company’s value proposition, key metrics, and Online Marketing Services.

At that time, the company wasn’t making any money from The Facebook, so they bet on solid numbers such as user engagement, customer base, and growth metrics.

- Industry: Social Media, Technology

- Business Model: Social networking and advertising platform

- Location: Menlo Park, California, USA

- Website: facebook.com

USE FACEBOOK TEMPLATE

10. Ycombinator Pitch Deck Template

YCombinator came out with a pitch deck template that's not aesthetically pleasing. We get it. They wanted to give you the “blank canvas” so your company branding could shine, but maybe they went too far. In any case, we've taken matters into our own hands and made some style changes for better aesthetics and more functionality. We hope this helps.

- Industry: Startup accelerator company

- Location: Mountain View, California, USA

- Website: ycombinator.com

USE YCOMBINATOR TEMPLATE

11. Guy Kawasaki Pitch Deck Template

Guy Kawasaki is a well-known Silicon Valley startup guru. He is the author of several books and was one of the original Apple employees. His 10 pitch deck slides have inspired many, and his 20-minute presentation format will help you get your point across efficiently.

USE GUY KAWASAKI TEMPLATE

12. Youtube Pitch Deck Template

Youtube’s pitch deck was used in 2005 when it had less than 10,000 users. It was actually quite straightforward. They used an elementary version of a 10 slide pitch deck to go up in front of Sequoia Capital for fundraising. Still, the company was able to raise $3.5M in that Series A round November of that year. This cost around 30% of the stakes in the company.

- Industry: Video Streaming, Music, Internet

- Business Model: Ad revenue and user subscriptions.

- Amount Raised: $3.5 million Series A

- Location: San Bruno, California, USA

- Website: youtube.com

USE YOUTUBE TEMPLATE

13. Slidebean Pitch Deck

Our slide deck at the 500 Startups demo day was the culmination of 2 startup accelerator processes, hours of rehearsal, and dozens of adjustments thanks to feedback from our mentors. Pitching at a Demo Day event differs from pitching to an investor in a one-on-one meeting.

- Industry: Software, Design, Productivity

- Business Model: Presentation software with design support

- Location: New York City, New York, USA

- Website: slidebean.com

USE SLIDEBEAN TEMPLATE

14. Peloton Pitch Deck Template

Peloton broke the fitness industry with its stationary bike system, which connects users and trainers via the internet. Do you have a business idea for this industry in mind? We recreated the pitch deck Peloton used to raise their Series F.

- Industry: Fitness, Technology

- Business Model: Subscription-based connected fitness platform

- Location: New York City, New York, USA

- Amount raised: $500 million Series F

- Website: onepeloton.com

USE PELOTON TEMPLATE

15. Go To Market Strategy Template

The go-to-market strategy is a presentation that details how an organization will place its products in the market to reach maximum penetration and profitability. What is your go-to-market strategy? This template will help you summarize it engagingly!

USE GO TO MARKET TEMPLATE

16. Elevator Pitch Deck Template

This is an elevator pitch deck template designed for initial approaches to investors. Share this template when they ask for your elevator pitch deck. With this template, you can effectively communicate your value proposition, market opportunity, key achievements, and financial projections, aiming to get the investors' curiosity and interest for further discussions.

Use this template

17. Tinder Pitch Deck Template

10 billion matches later, Tinder has changed how people meet around the world. It’s so much more than a dating app. Tinder is a powerful tool for meeting people.

Here’s the deck Tinder used in the IAC Hatch Labs Incubator in 2012.

- Industry: Social Media, Dating App

- Business Model: Subscription service, ad revenue

- Amount Raised: Approximately $50 million in total funding

- Location: West Hollywood, California, USA

Use this template

18. WeWork Pitch Deck Template

WeWork fuels entrepreneurial spirit and corporate success with powerful real estate solutions. Founded in 2010, it has since blossomed into a buzzing global community transforming the way companies do business by providing physical spaces that nurture productivity, well-being, efficiency and growth - all backed up by an impressive $1 billion funding valuation of $10 billion!

- Industry: Real Estate, Coworking, Proptech

- Business Model: Office space rental

- Amount Raised: $42.8 million Series E

- Location: New York, New York, USA

- Website: wework.com

GET THIS TEMPLATE

19. Snapchat Pitch Deck Template

The Snapchat Pitch Deck Template helps you create a persuasive presentation inspired by Snapchat's successful pitch to investors. It offers visually engaging slides and a structured format for showcasing your business idea, growth plans, and revenue strategy.

- Industry: Social Media, Messaging, Technology

- Business Model: Photo-based social media

- Amount Raised: Approximately $4.9 billion in total funding

- Location: Venice, California, USA

Use this template

20. Linkedin Pitch Deck

LinkedIn has skyrocketed to success, becoming the world's largest professional social networking site with a vast population of users growing daily. Reid Hoffman later publicly released his Series B pitch deck, which included advice on how it should be constructed so that other aspiring entrepreneurs would also have insight.

- Industry: Social Media, Networking, Technology

- Business Model: Professional networking site

- Amount Raised: $10 million Series B

- Location: Sunnyvale, California, USA

- Website: linkedin.com

Get this template

21. Lunchbox Pitch Deck Template

With a mission to empower restaurants to compete in an increasingly tech-driven market, Try our Pitch Deck Template inspired by the one they used to raise $2 million in its seed round.

- Industry: Restaurants, Management Software

- Business Model: B2B Restaurant platform

- Amount Raised: $2 million Seed Round

- Location: New York, New York, USA

- Website: lunchbox.io

Use this template

22. Buffer Pitch Deck Template

This is the presentation deck Buffer used to raise $500,000 for their startup, as redesigned by Slidebean. The highlight of this deck is the traction slide, which the founders describe as the critical one for their success.

- Industry: Social Media, Technology

- Business Model: Social media management platform

- Amount Raised: $500K

- Location: San Francisco, California, USA

- Website: buffer.com

USE BUFFER TEMPLATE

23. Cannabis Investor Pitch Deck Template

Leverage our Cannabis Investor Pitch, influenced by the CannaBusinessPlans deck, to effectively showcase the distinctive attributes and growth potential of your cannabis business. Utilize this tailored presentation as a powerful tool to attract essential funding from potential investors

Use this template

24. Aircall Pitch Deck

A well-designed pitch deck can help an entrepreneur communicate their story in a clear and concise way and can be a key tool in securing funding. However, designing a pitch deck can be a challenge, as it requires distilling complex information into bite-sized chunks and conveying it in an engaging way. That's why we decided to redesign Aircall's pitch deck as an example. We wanted to show how a pitch deck can be both informative and visually appealing.

- Industry: Telecommunications, Technology

- Business Model: Cloud-based phone system and call center software

- Amount Raised: $65 million

- Location: Paris, France, and New York City, USA

- Website: aircall.io

Here's the result from our design challenge:

Use Aircall Template

25. Intercom Pitch Deck Template

The Intercom Pitch Deck Template is your key to crafting a compelling pitch presentation, modeled after Intercom's own successful pitch.

It's your tool to create a persuasive presentation that mirrors Intercom's winning pitch style. This template empowers you to clearly communicate your business vision, product strategy, and growth prospects to potential investors.

- Industry: CRM, Marketing, Automation

- Business Model: B2B SaaS

- Amount Raised: $600K

- Location: San Francisco, California, USA

- Website: intercom.com

Use this template

26. Cryptocurrency Pitch Deck Template

A cryptocurrency pitch deck is a dynamic presentation outlining the unique attributes of a digital currency project. It showcases use cases, team expertise, and financial projections to attract funding and build investor confidence.

Use this template

27. Copy AI Pitch Deck Template

Copy.ai offers the convenience of composing emails, website content, and heartfelt love letters. Here's the pitch deck that convinced investors like Wing, Sequoia, and Tiger Global to contribute $11 million in funding.

- Industry: SAI, Copywriting, Automation

- Business Model: SaaS

- Amount Raised: $11 Series A

- Location: Memphis, Tennesee, USA

- Website: copy.ai

Use this template

28. Splitwise Pitch Deck Template

Splitwise makes it super easy to divvy up bills and expenses among friends or groups with their simple app. Check out our Pitch Deck Template, inspired by Splitwise's $20 million Series A round, to show investors what you're all about and kickstart your journey to success.

- Industry: FinTech, Billing, Personal Finance

- Business Model: Ad revenue, subscription service

- Amount Raised: $20 million Series A

- Location: Providence, Rhode Island, USA

- Website: splitwise.com

Use this template

29. 3 Minute Pitch Deck for Demo Day Template

Demo days pack together dozens of pitch decks from wildly different companies. Communicating your value prop effectively and concisely is key. This template provides the structure to accomplish pitching your startup in under 3 minutes.

Use 3 Minute Pitch Deck

30. Sparkcharge Pitch Deck

Sparcharge is a startup that raised $7 million in seed funding, and Slidebean was responsible for writing and designing their pitch deck. The deck was very successful in conveying the company's value proposition and vision, and it helped them to secure funding from top venture capitalists. The design of the deck was clean and professional, and it made use of strong visuals to help tell the company's story. The slides were also easy to navigate, which made it easy for investors to understand the information presented. Overall, the pitch deck was an important part of Sparcharge's success in raising funding, and it served as a great example of the power of a well-designed presentation.

- Industry: Automotive, Energy, Technology

- Business Model: Electric vehicle charging infrastructure

- Amount Raised: $7 million Series A

- Location: Boston, Massachusetts, USA

- Website: sparkcharge.io

Check these Slides

31. Dwolla Pitch Deck Template

Dwolla is advertised as "the best way to move money." 28-year-old Ben Milne has found a way to transfer money from the consumer or merchant to make a payment. This is Dwolla's Pitch Deck.

- Industry: Fintech

- Business Model: SaaS, transaction fees, partnerships

- Amount Raised: $16.5 million, Series C

- Location: Des Moines, Iowa, United States

- Website: dwolla.com

Use this template

32. Evervault Pitch Deck Template

According to their website, Evervault's mission "is to make data privacy simple and accessible for all" by allowing developers to integrate data privacy in their apps. How did they gain their attention (and money)? Here's the pitch deck that made that happen, as redesigned by Slidebean.

- Industry: Encryption Software

- Business Model: usage-based

- Amount Raised: $3.2 million, Seed Round

- Location: Dublin, Ireland

- Website: evervault.com

Use Evervault template

33. Vettery Pitch Deck Template

Here’s the Vettery pitch deck used to raise $9 million Series A on August 16, 2016, by co-founders Brett Adcock and Adam Goldstein.

- Industry: Hiring marketplace

- Business Model: SaaS, transaction fees

- Amount Raised: $9 million, Series A

- Location: New York, United States

- Website: hired.com

Use Vettery template

34. Dutchie Pitch Deck Template

Dutchie is one of the fastest-growing cannabis companies in the world. They provide e-commerce and point-of-sale solutions for dispensaries across North America.

- Industry: Cannabis

- Business Model:

- Amount Raised: $35 million Series B

- Location: Oregon, United States

- Website: business.dutchie.com

Use Dutchie template

35. Sololearn Pitch Deck Template

Sololearn, the Armenia-based instructional coding app, revolutionizes how people learn to code, with interactive lessons and peer-to-peer guidance.

- Industry: Ed-tech startup

- Business Model: Freemium, SaaS, Partnerships

- Amount Raised: $24 million Series B

- Location: San Francisco, California, United States

- Website: sololearn.com

Use Sololearn template

What is a pitch deck?

A pitch deck is usually a simple 10-20 slide presentation designed to help founders raise venture capital.

It should give a brief and compelling presentation of a new business idea that entrepreneurs give to potential investors, customers, or partners. It's a chance for them to showcase their vision, explain their unique value proposition, and demonstrate their growth potential.

To create an effective pitch deck, it's crucial to cover a few key points, such as the problem the startup is addressing, the market opportunity it has identified, the team's expertise, and the execution plan. Moreover, highlighting the competitive advantage and potential return on investment can attract investors' attention and interest.

A successful pitch can lead to funding, partnerships, and growth opportunities. However, crafting one requires in-depth knowledge of the market, audience, and business model, as well as excellent communication and storytelling skills.

What should be in an investor deck presentation?

When creating a pitch deck presentation, it's important to remember that you only have a limited amount of time to capture your audience's attention and persuade them to invest in your company. Your deck should be concise and easy to understand, while still providing enough information to show that your business is worth investing in.

Some key things to include in your pitch deck are an overview of your business, information about your target market and competitors, your product or service, how you plan to make money, and a summary of your team. You should also have a section highlighting the risks and challenges associated with your business, as well as what sets you apart from the competition.

Most authors agree on the following investor pitch deck outline requirements:

- Problem

- Solution

- Product

- Market Size

- Business Model

- Underlying Magic

- Competition

- Better/Different

- Marketing Plan

- Team Slide

- Traction / Milestones

If you're looking for more specific advice on creating a pitch the Slidebean team can guide you through the whole process.

Remember, investors have limited time, so be sure to prioritize key elements like the problem you're solving, your target market, the competitive landscape, your unique value proposition, and your financial projections.

More FAQs about pitch decks:

How to create a great pitch deck?

Your pitch deck is one of the most important tools in your arsenal. If you're pitching your startup idea or product, it's an opportunity to make a lasting impression on potential investors. And while there are many different types of decks out there, the best ones focus on three key points:

1. What problem do you solve?

2. How do you solve that problem?

3. Why should someone invest in you?

The presentation itself shouldn't take longer than 15 minutes, and it should be easy to follow along.

How to design pitch decks for investors?

A pitch deck is an important tool when pitching investors. It helps you present your business idea clearly and concisely, so they understand exactly why their investment will be profitable.

The first step is to create a list of all the things that need to be included in your pitch deck. For example, you may want to include:

- A clear description of your product/service

- An overview of your company's mission statement

- Your target market

- The benefits your product offers

- How much money you expect to raise

- Why your startup is unique

- What are your plans for growth

Once you have created this list, you can begin designing your pitch deck. You'll need to choose a template that best suits your needs. We offer over 100+ different pitch deck templates that can be used as inspiration.

How to write a successful pitch deck?

Mastering the art of creating an irresistible pitch deck can seem like a daunting task, but it shouldn’t. We're here to guide you through the process. First and foremost, you need a compelling narrative that showcases your business idea, market opportunity, and growth potential. Keep your pitch deck concise and visually appealing, with clear, simple language that gets straight to the point.

Remember, investors have limited time, so be sure to prioritize key elements like the problem you're solving, your target market, the competitive landscape, your unique value proposition, and your financial projections.

Now, if you're feeling a bit overwhelmed or simply want to supercharge your pitch deck, Slidebean's Agency Team is here to save the day. Our seasoned experts have a proven track record of helping companies raise more than $300 million in funds, and they're eager to help you reach the same heights. From crafting a compelling narrative to designing stunning visuals that captivate investors, our Agency Team will work with you every step of the way to create a pitch deck that not only looks great but also delivers results. With Slidebean by your side, you can focus on what you do best - building your business - while we take care of the rest.

Pitch Deck Presentation Service

Slidebean provides a premium service for startups, entrepreneurs, investors, and creatives who want to make better presentations. Our team of experts designs amazing slide decks every week. We want your audience to understand what you do and why you do it. If you want to start a new project, you can do it here: Slidebean Presentation Design Service

Besides the pitch deck examples we shared here, we have created, curated and redesigned several investor deck and set them as templates on our platform. Our presentation templates provide a fill-in-the-blank outline that can kick start your presentation workflow. Create a pitch deck that gets you funded. Browse templates from the most successful startups on the planet. Check them all here.

Get 100+ Templates

What is the goal of a company pitch deck?

The main goal of a company pitch decks is to:

- Attract investment from potential investors.

- Clearly explain what the company does and why it's valuable.

- Build trust in the team and business strategy.

- Show the market opportunity and growth potential.

- Highlight achievements and progress.

- Present financial projections.

- Request a specific amount of funding.

- Spark interest for further discussions.

How much does it cost to make a pitch deck?

There is no one-size-fits-all answer to this question, as the cost of making a pitch deck will vary depending on the level of detail and complexity involved. However, on average, you can expect to pay around $1,200-$6,000 for a high-quality investor deck. You can check Slidebean's prices here.

What is a Demo day?

A demo day refers to an event where entrepreneurs and startups showcase their products or services to potential investors, industry experts, and the general public. It is typically organized by incubators, accelerators, or venture capital firms to provide a platform for startups to present their business ideas, prototypes, or early-stage products.

During a demo day, each participating startup is given a specific amount of time, usually ranging from a few minutes to around 10 minutes, to deliver a presentation or pitch. The objective is to captivate the audience, generate interest in their venture, and attract potential investors or partners.

The text you provided highlights some key considerations when preparing for a demo day presentation versus a pitch deck presentation. For a demo day, the emphasis is on delivering a visually appealing presentation with minimal text. Since the audience may be seated at a distance, it is important to focus on visual elements that can be easily seen and understood. The presenter plays a crucial role in conveying the information and engaging the audience.

In contrast, a pitch presentation that is intended to be emailed should be self-explanatory, as it may be viewed on a laptop monitor where smaller fonts can be read comfortably. It is beneficial to track the recipient's activity on the presentation, such as whether they have read all the slides, as this information can inform the frequency of follow-up emails and help gauge their level of interest.

These considerations and tools for tracking viewer engagement are particularly valuable when seeking investment opportunities. Startups can utilize pitch deck platforms that offer features to monitor investor activity, which can play a critical role in securing funding.

Create beautiful and simple pitch decks with Slidebean

Unlock your full pitching potential with Slidebean! Say goodbye to design headaches and hello to a seamless experience focused on your pitch content. With customizable templates, stunning visuals, and automated formatting, Slidebean ensures your pitch deck stands out from the competition. Don't waste another minute wrestling with design software. Try Slidebean now and take your pitches to the next level!